People have seen food and energy prices surge over the past years. Millions of people in the EU are struggling to pay for heating and food. Right now, over 36 million people in Europe cannot afford a quality meal every second day. While 50 – 125 million of us are unable to pay for proper heating.

And the situation has only got worse since the start of Russian aggression in Ukraine. A ton of wheat was already worth more than 475$ in January 2022, compared to 275$ just a year before. During 2021, wholesale electricity prices increased by 200%, plunging thousands of people into energy poverty. In May 2022, food inflation reached 7.5%.

The consequences of this price explosion are devastating. Every time food prices rise by just 1%, 10 million people are thrown into extreme poverty worldwide. We need to tackle the price surge at its root. Households across Europe are reporting a day-to-day rise in living costs and many people are feeling the effects. But, the ramifications of skyrocketing food prices are literally life-threatening in developing countries where many people are already struggling to afford basic food.

In this article, we will try to shine a light on the different factors that play a role in the spike in food prices. Prices are going up, but where is the extra money going? Who is profiting? What is food speculation and how does it drive up prices for basic foods that we rely on, like grain and wheat? And what can we do to tackle this problem?

Why the collapse of food and fertiliser production leads to inflation

As a direct consequence of the war in Ukraine, food and fertiliser production and exports from the most affected countries (Ukraine, Russia and Belarus) have collapsed. The effect of the war has been especially dramatic for food production because these countries produce a huge portion of our food needs in this part of the world (see our blog on the consequences of the war in Ukraine on our food system).

As a result, we’ve seen a rise in food inflation: the less food being produced, the higher the prices. However, these extreme price increases are not all down to basic supply and demand. Investors playing roulette with our food are exacerbating this.

How speculators on the financial market are driving the rise in food prices

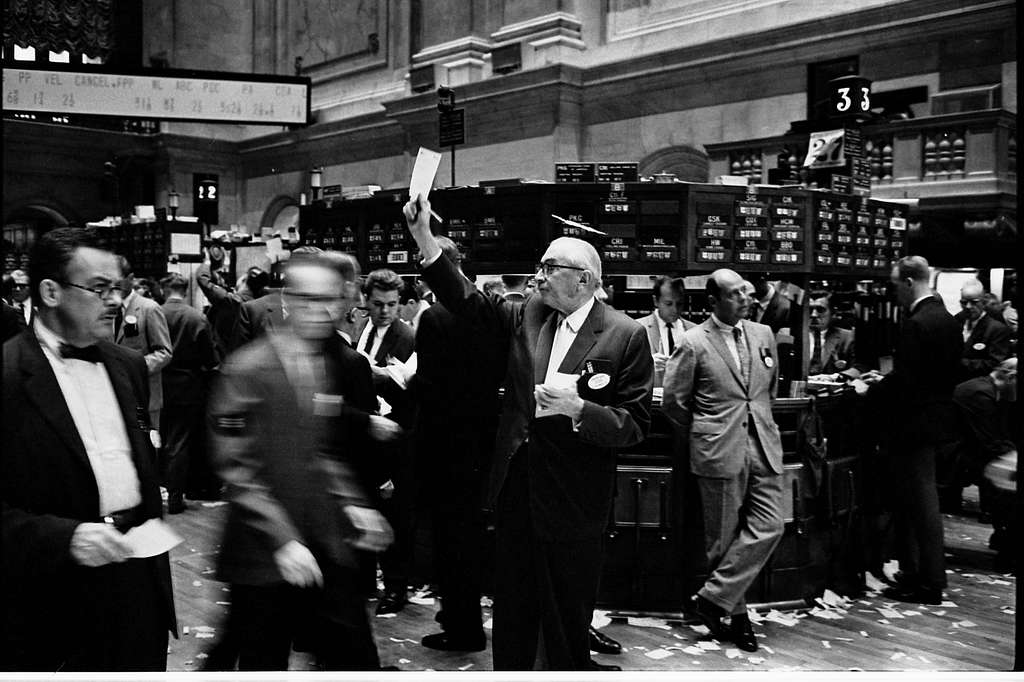

Food speculation is driving the wild increase in food prices. Food speculators bet on food prices by buying futures contracts from farmers. They don’t actually want to buy the food, of course – they’re gambling that prices will go up and they will be able to sell on the contract and make a quick buck. In situations of crisis and market instability – like now, with Putin’s war in Ukraine – they act as hunger and war profiteers.

Indeed, in the immediate aftermath of the crisis, speculation on food commodities reached its peak. And the gamble paid off. Speculators who were specialised in trading agricultural commodities, such as Teucrium Wheat Fund, reported unprecedented profits which saw their share price beating all-time records.

However, food speculators betting on our basic foodstuffs makes food markets highly volatile. They play with the principle of supply and demand, which can mess with a fair market and contribute to a sharp increase in food prices.

Social instability – speculation on the food market has led to uprisings and revolutions before

Although food speculation shot up in the aftermath of the war, it is not a new phenomenon.

Speculation was already at the heart of the financial crisis of 2007 which led to a food crisis a year later. Experts consider this one of the major causes of the Spring uprising in North African and Middle-Eastern countries. Following this, in 2009, the G7 countries (Canada, France, Germany, Italy, Japan, the UK and the US) and the EU all committed to putting an end to food speculation. Legislators have adopted some rules since then, such as the Markets in Financial Instruments Directive (MiFiD) in the EU or the Dodd-Franck Act in the US.

But, these have not stopped food speculation. In fact, the share of speculators in the market has increased since 2020 – and especially for some crucial foods that many countries depend on, such as wheat. Likewise, recent studies show that gas trading on financial markets is 114 times more important than actual gas consumption.

For food security and stability – the EU needs stronger rules to fight speculation on the food market

The EU law to regulate market speculation is called the Markets in Financial Instruments Directive (MiFiD) – and it’s currently up for review. This is a unique opportunity to tackle food and energy speculation once for all. Yet, the new rules being proposed by the European Commission are still too lenient to curb excessive speculation on vital commodities, like food and energy. The EU’s rules are even more permissive than the US ones. It is also astonishing that, so far, the European Commission has not taken the time to properly assess the role of speculation in the rise of food and energy prices.

If it is serious about preventing speculation, the EU needs to do two things. One, apply strict limits to the capacity of a trader to speculate on food and energy commodities. And two, fix the loopholes in the regulatory framework. Speculators will use any regulatory gap to circumvent the rules and make profit at the expense of the poorest.

Fighting food speculation and food scarcity – ways forward to stabilise food prices

There is still time to make a change and save thousands of lives. The Greens/EFA are asking the European Commission and specialised EU agencies (like the European Securities and Markets Authorities (ESMA)) to run a full analysis of speculation as a driver of price increases in food and energy.

We are also calling on the EU institutions to investigate any harmful behaviour, such as financial traders deliberately pushing commodity prices upward to make more profit.

The Greens/EFA are leading the fight against hunger and war profiteers. We’re doing everything in our power to make sure that food and energy speculation cannot happen anymore. There is no time to waste.