The economy belongs to everyone. We all participate in it and we are all obliged to pay our fair share. But not everyone is contributing: despite the cost of living crisis which is squeezing us all at the end of the month, billionaires have increased faster than ever and multinationals have raked in extreme profits at the expense of the most vulnerable. Yet their tax burden is close to zero.

Give the billions back to the millions

We cannot afford an economy that favours billionaires, shareholders and multinationals over workers, families and the planet. Having fair societies where everyone contributes proportionately is not a dream, it can be a reality. All it takes is the political will to put the billions at the service of the millions. All we need to do is change the rules of the game. So that those who have the most, contribute the most.

Tax the rich

We can and we must start taxing the wealthiest individuals and shareholders. Workers cannot be the ones that pay the highest tax rates in our societies while those who have the most hide their wealth in tax havens or store it right in front of our eyes in mansions and luxury items.

- We need the money to invest in a green future, one where both the planet and the people can thrive.

- We need to invest in our public services, the pillars of our societies.

- We cannot have an economy that is built to favour the top 0.5%.

- The economy needs to work for the people and respect our planetary boundaries, not the other way around.

However, there is a lack of investment in the just green transition. And the recent reform of the EU’s economic governance rules will only make this worse. This means we need alternative strategies to channel investments, and a renewed focus on tax justice at EU level.

It’s time to make “tax the rich” go from slogan to reality. Because if the top 0.5% of the richest people in the EU paid just a small tax of 2%, we could get 213.3 BILLION euros a year. That is the equivalent of over 80% of our yearly energy bills. It’s the salaries of over 7 million teachers across Europe or an increase of 20% of the healthcare spending. So instead of having CEOs lecture us about how we need to drop our coffees to be able to afford a home, how about we start making the economy a bit more fair by making those who have the most contribute their fair share?

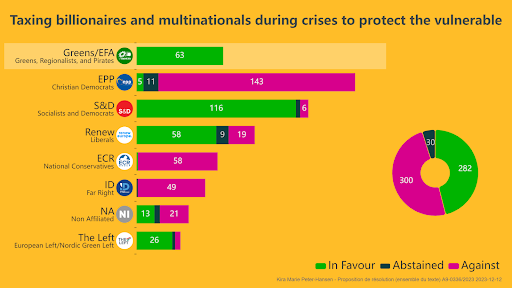

Sadly, even if it’s common sense, not everyone is willing to prioritise the livelihoods and wellbeing of the majority. Even when the cost of living crisis and inflation rates were at their worst, a coalition of conservatives, far right and liberals voted against a call to have fair taxation systems to protect the most vulnerable during times of crises.

We need fair economic rules

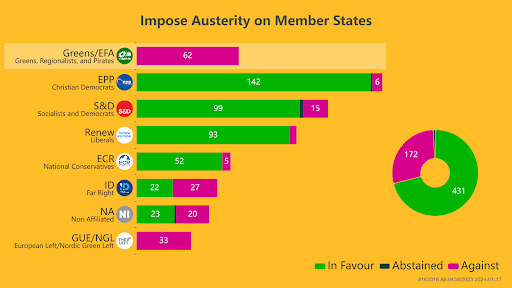

And the reason why there will continue to be a dire lack of public investment is because of the economic straitjacket the EU has put upon itself and all the national governments. Despite the clear failures of the old economic models of deficit and debt limits, the revised EU economic governance rules obey these outdated dogmas, entrenching them even further in what promises to be a harsher round of austerity than we have ever seen before.

This happened because the greens and left were clearly outnumbered by the mainstream political groups, who, with the support of the Socialist and Democrats, had a wide majority to approve this disastrous reform, despite the warnings from economists and trade unionists about the negative impact this would have on our economies, our investment capacity, and our essential services.

Things have to change. We need new economic rules, ones that are fit for the future that we all deserve, ones that put people and planet at the forefront, ones that are made to last and not lurch from crisis into crisis.

To achieve a fair economy we must raise our voices and stand together. We need to achieve an economy that works for us: young people, working families, small businesses. We need to build an economy that works for the people and the planet, not one that sides with billionaires and multinationals, whilst leaving everyone else unprotected.

This means:

- Taxing capital and shares at the same or higher rate than work.

- Taxing billionaires.

- Having more transparency so that no one can hide their wealth in tax havens.

- Investing public money in the pillars of our societies and our public sector.

- Investing public money to fight the climate emergency.